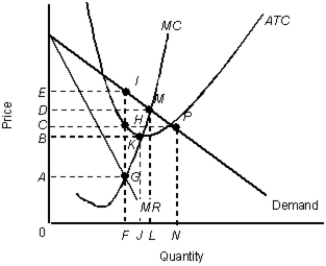

The figure given below shows the revenue and cost curves of a monopolistically competitive firm.Figure 12.4

MR: Marginal revenue curve

MR: Marginal revenue curve

ATC: Average total cost curve

MC: Marginal cost curve

-Which of the following statements about a monopolistically competitive firm, in the short run, is true?

Definitions:

Lending Money

The act of giving money to another party with the expectation of receiving the money back plus interest or other benefits.

Collecting Loans

The process of obtaining repayment of a loan or debt, including the principal and any accrued interest.

Investing Activities

Financial activities related to the acquisition and disposal of long-term assets and other investments not considered as cash equivalents.

Financing Activities

Financial transactions primarily involved with funding the company and its capital structure, including issuing debt, paying off debt, and equity transactions.

Q33: Refer to Figure 9.3. The profit-maximizing level

Q59: The labor-market-supply curve illustrates that, as the

Q62: Often the best way for a firm

Q65: In Figure 11.6, assume that marginal costs

Q87: In the short run when output is

Q88: At long-run equilibrium of a perfectly competitive

Q92: A perfectly competitive firm decides to shut

Q96: For a monopolist with a linear demand

Q106: In many cities, the market for cab

Q110: The principal argument against comparable worth is