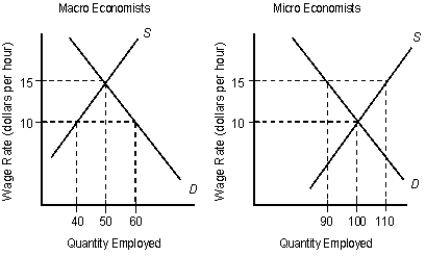

The following figures show the demand (D) and supply (S) curves of micro and macro economists.Figure 16.6

-An individual's decision to supply her labor or to spend her time in leisure activity is known as the labor-leisure tradeoff.

Definitions:

Marginal Tax Rate

The amount of tax paid on an additional dollar of income, used in progressive tax systems to ensure higher incomes are taxed at higher rates.

Federal Income Tax

The United States federal government imposes a financial charge on the yearly revenues of individuals, corporations, trusts, and other legal entities.

Marginal Tax Rate

The tax rate that applies to the next additional increment of a taxpayer's taxable income.

Taxable Income

The portion of an individual's or a corporation's income that is subject to taxation by the government.

Q9: It has been proved empirically that marriage

Q52: All of the following will shift the

Q76: Advertising, brand names, packaging, and celebrity endorsements

Q81: If new firms enter a monopolistically competitive

Q96: In order to survive, cartels must be

Q98: In Figure 17.1, if the initial demand

Q101: In monopolistic competition, firms may differentiate their

Q108: The marginal revenue product is:<br>A)the value of

Q110: If people expect the price of a

Q112: Actions that allow oligopoly firms to coordinate