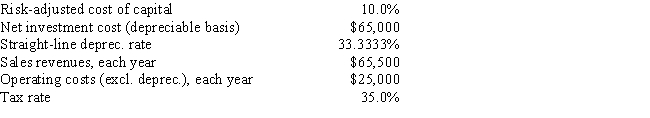

DeVault Services recently hired you as a consultant to help with its capital budgeting process. The company is considering a new project whose data are shown below. The equipment that would be used has a 3-year tax life, would be depreciated by the straight-line method over its 3-year life, and would have a zero salvage value. No new working capital would be required. Revenues and other operating costs are expected to be constant over the project's 3-year life. What is the project's NPV?

Definitions:

Q3: The capital intensity ratio is generally defined

Q13: The project charter should include as many

Q15: A project is an endeavor to accomplish

Q18: Which of the following statements is CORRECT?<br>A)

Q25: The Eurodollar market is essentially a long-term

Q29: The constraints for a project include the

Q42: Superior analytical techniques, such as NPV, used

Q51: Poff Industries' stock currently sells for $120

Q70: The NPV and IRR methods, when used

Q93: For large or complex projects, it may