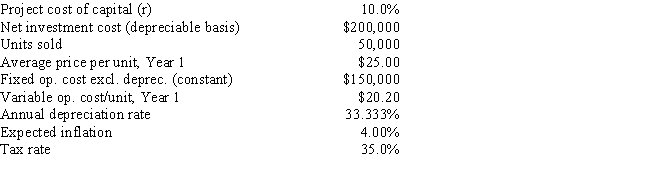

Sylvester Media is analyzing an average-risk project, and the following data have been developed. Unit sales will be constant, but the sales price should increase with inflation. Fixed costs will also be constant, but variable costs should rise with inflation. The project should last for 3 years, it will be depreciated on a straight-line basis, and there will be no salvage value. This is just one of many projects for the firm, so any losses can be used to offset gains on other firm projects. The marketing manager does not think it is necessary to adjust for inflation since both the sales price and the variable costs will rise at the same rate, but the CFO thinks an adjustment is required. What is the difference in the expected NPV if the inflation adjustment is made vs. if it is not made?

Definitions:

Holder-of-Record Date

The date set by a corporation by which an individual must be registered as a shareholder to be eligible to receive dividends or distributions.

Stock Rights

Entitlements issued to existing shareholders, giving them the privilege to buy more shares of the corporation at a future date at a predetermined price.

Designated Recipients

Individuals or entities chosen to receive certain benefits or transfers, such as proceeds from a will or insurance policy.

Underwriting Syndicate

A group of financial institutions that work together to issue new securities to the public, sharing the risk and profit.

Q1: Trade credit can be separated into two

Q3: Scott Enterprises is considering a project that

Q16: For a project with one initial cash

Q25: Fireside Inc. has the following data. What

Q39: Which of the following statements is CORRECT?<br>A)

Q51: Which of the following statements is CORRECT?<br>A)

Q64: Silverman Co. is considering Projects S and

Q69: The work packages are at a level

Q87: A firm's collection policy, i.e., the procedures

Q100: Suppose a firm changes its credit policy