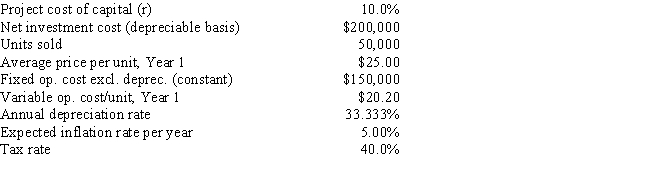

Shultz Business Systems is analyzing an average-risk project, and the following data have been developed. Unit sales will be constant, but the sales price should increase with inflation. Fixed costs will also be constant, but variable costs should rise with inflation. The project should last for 3 years, it will be depreciated on a straight-line basis, and there will be no salvage value. This is just one of many projects for the firm, so any losses can be used to offset gains on other firm projects. What is the project's expected NPV?

Definitions:

Collateralized Debt Obligation

A complex structured finance product that pools together cash flow-generating assets and repackages this asset pool into tranches that can be sold to investors.

CDO

Collateralized Debt Obligation, a type of structured asset-backed security (ABS) with multiple tranches that is issued by special purpose entities and collateralized by debt obligations.

Zero-Coupon Bond

A bond that does not pay periodic interest payments and is instead issued at a significant discount to its face value and pays its full face value at maturity.

Yield To Maturity

The total return anticipated on a bond if it is held until its maturity date, taking into account its current market price, par value, coupon interest rate, and time to maturity.

Q6: Which of the following statements is correct?<br>A)

Q9: If an investment project would make use

Q14: A firm's profit margin is 5%, its

Q26: One drawback of switching from a partnership

Q28: All the work involved with clearing a

Q28: Stock dividends and stock splits should, at

Q54: A revolving credit agreement is a formal

Q63: The maturity of most bank loans is

Q64: Silverman Co. is considering Projects S and

Q70: The NPV and IRR methods, when used