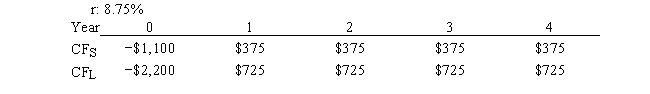

Silverman Co. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

Definitions:

Corporate Spending

Refers to the use of funds by a corporation to invest in its own operations, purchase assets, or contribute to external entities like political campaigns.

Impeachment Charges

Formal accusations made against a high-ranking government official, leading to a trial and possibly removal from office if convicted.

Extramarital Affair

A sexual relationship between a married person and someone who is not their spouse.

Grand Jury

A legal body empowered to conduct official proceedings to investigate potential criminal conduct and to determine whether criminal charges should be brought.

Q1: The minimum growth rate that a firm

Q20: Assuming that their NPVs based on the

Q30: Determining a firm's optimal investment in working

Q44: If a firm sells on terms of

Q52: A good way to start a conversation

Q61: The CFO of Cicero Industries plans to

Q62: The risk to the firm of borrowing

Q63: VR Corporation has the opportunity to invest

Q88: Whitson Co. is looking for ways to

Q88: The work breakdown structure is the same