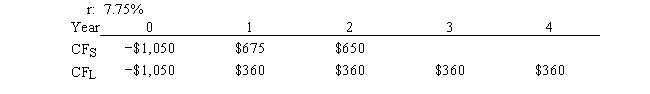

Carolina Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under some conditions choosing projects on the basis of the IRR will cause $0.00 value to be lost.

Definitions:

Macrophages

A type of white blood cell part of the immune system, responsible for detecting, engulfing, and destroying pathogens and dead cells.

Null Cells

Lymphocytes that lack surface markers distinctive of T or B cells, often associated with natural killer cell activity.

Variable Regions

Parts of antibodies that differ from one antibody to another, enabling them to bind to a specific antigen.

T-cell Receptors

These receptors on the surface of T-cells recognize and bind to antigens presented by other cells, initiating an immune response.

Q3: The capital intensity ratio is generally defined

Q11: When a firm has risky debt, its

Q25: Describe the benefits and consequences of the

Q30: Determining a firm's optimal investment in working

Q30: LeCompte Learning Solutions is considering making a

Q48: Which of the following statements is CORRECT?<br>A)

Q50: You are on the staff of O'Hara

Q54: The focus must be on relying on

Q65: A project has a clear objective.

Q75: Refer to the data for the Anson