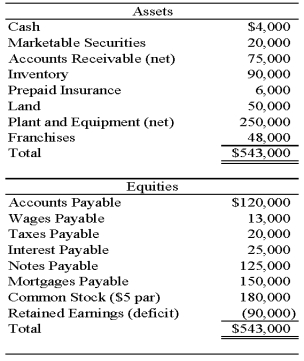

Wilbur Corporation is to be liquidated under Chapter 7 of the Bankruptcy Code.The balance sheet on December 31,2008,is as follows:

The following additional information is available:

1.Marketable securities consist of 2,000 shares of Bristol Inc.common stock.The market value per share of the stock is $8.The stock was pledged against a $20,000,8 percent note payable that has accrued interest of $800.

2.Accounts receivable of $40,000 are collateral for a $35,000,10 percent note payable that has accrued interest of $3,500.

3.Inventory with a book value of $35,000 and a current value of $32,000 is pledged against accounts payable of $60,000.The appraised value of the remainder of the inventory is $50,000.

4.Only $1,000 will be recovered from prepaid insurance.

5.Land is appraised at $65,000 and plant and equipment at $160,000.

6.It is estimated that the franchises can be sold for $15,000.

7.All the wages payable qualify for priority.

8.The mortgages are on the land and on a building with a book value of $110,000 and an appraised value of $100,000.The accrued interest on the mortgages is $7,500.

9.Estimated legal and accounting fees for the liquidation are $10,000.

Required

a.Prepare a statement of affairs as of December 31,2008.

b.Compute the estimated percentage settlement to unsecured creditors.

Definitions:

Q3: Akron established an internal service fund for

Q8: Which of the following statements is(are)correct about

Q8: Which of the following observations is true

Q10: Works of art and historical treasures purchased

Q15: Indirect costs of bankruptcy are born principally

Q22: Agency costs as the sum costs of:<br>A)

Q26: The general fund of Athens ordered computer

Q47: Based on the preceding information,in the entry

Q58: At the end of the fiscal year,uncollected

Q78: A private,not-for-profit geographic society received cash contributions