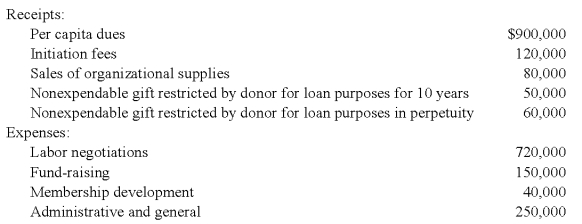

Golden Path,a labor union,had the following receipts and expenses for the year ended

December 31,2008:

The union's constitution provides that 12 percent of the per capita dues be designated for the strike insurance fund to be distributed for strike relief at the discretion of the union's executive board.

-Based on the information provided,in Golden Path's statement of activities for the year ended December 31,2008,what amount should be reported under the classification of revenue from unrestricted funds?

Definitions:

Marriage

A recognized union under law and society between people that creates duties and privileges among them and their relatives.

Second Marriages

Marital unions that occur after one or both partners have been married previously.

Divorce

The process where a marriage is officially ended by a court or a recognized authority.

Egalitarian

A belief or doctrine that advocates for equal rights, benefits, and opportunities for all members of society, regardless of status or gender.

Q1: The use of WACC to select investments

Q1: Retained earnings are:<br>A) the amount of cash

Q4: A growth stock portfolio and a value

Q7: Received pledges from donors who placed no

Q13: A levered firm is a company that:<br>A)

Q18: Suppose that we have identified three important

Q40: Wilbur Corporation is to be liquidated under

Q47: Which of the following funds are classified

Q49: Based on the preceding information,had Myway not

Q70: A private,not-for-profit hospital received contributions of $50,000