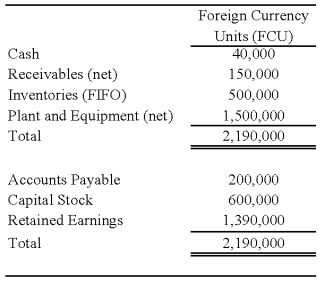

On January 2,2008,Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Perth's balance sheet contained the following information:

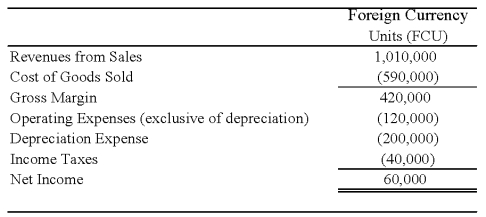

Perth's income statement for 2008 is as follows:

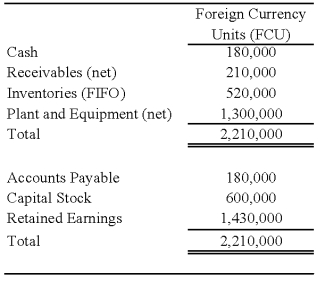

The balance sheet of Perth at December 31,2008,is as follows:

The balance sheet of Perth at December 31,2008,is as follows:

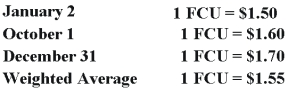

Perth declared and paid a dividend of 20,000 FCU on October 1,2008.Spot rates at various dates for 2008 follow:

Assume Perth's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 2008.

-Refer to the above information.Assuming Perth's local currency is the functional currency,what is the amount of translation adjustment that appears on Johnson's consolidated financial statements at December 31,2008?

Definitions:

Book Of Vouchers

A ledger or book that contains vouchers, which are documents or files acting as evidence for transactions.

Gross Method

A method of recording purchases of inventory at their gross price without any deduction for trade discounts at the time of purchase.

Periodic Inventory Method

An accounting approach where inventory values and cost of goods sold are determined at the end of an accounting period through physical inventory counts.

Purchases Discount

A reduction in the invoice price of goods, granted by the seller to the buyer for early payment within a specified time frame.

Q2: Based on the preceding information,in the preparation

Q3: Based on the preceding information,the journal entry

Q16: Colton Company acquired 80 percent ownership of

Q17: Zeta Corporation and its subsidiary reported consolidated

Q20: Based on the preceding information,Connector's total assets

Q23: Identify the regulation that created an entity

Q24: Based on the preceding information,what amount of

Q36: Based on the preceding information,what amount will

Q40: What account is debited in a debt

Q41: The history of securities regulation can be