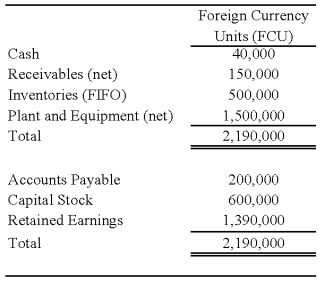

On January 2,2008,Johnson Company acquired a 100% interest in the capital stock of Perth Company for $3,100,000.Any excess cost over book value is attributable to a patent with a 10-year remaining life.At the date of acquisition,Perth's balance sheet contained the following information:

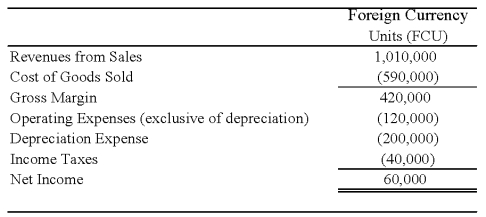

Perth's income statement for 2008 is as follows:

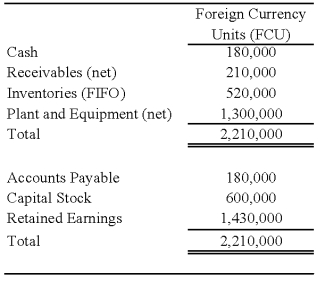

The balance sheet of Perth at December 31,2008,is as follows:

The balance sheet of Perth at December 31,2008,is as follows:

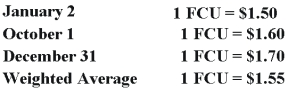

Perth declared and paid a dividend of 20,000 FCU on October 1,2008.Spot rates at various dates for 2008 follow:

Assume Perth's revenues,purchases,operating expenses,depreciation expense,and income taxes were incurred evenly throughout 2008.

-Refer to the above information.Assuming the U.S.dollar is the functional currency,what is Perth's net income for 2008 in U.S.dollars (include the remeasurement gain or loss in Perth's net income) ?

Definitions:

Behavioral Segmentation

The division of a market into groups based on consumer behaviors, such as purchasing habits or product usage.

Usage Rate

The frequency at which a consumer uses a product or service over a specific period, indicating their level of engagement or reliance on it.

Loyalty

The quality of being faithful to commitments or obligations, often used to describe customer behavior and the likelihood of continued patronage or support.

Strategic Fit

The alignment between an organization's strategic goals and the resources and capabilities at its disposal to achieve them.

Q4: Based on the information given above,what percentage

Q16: On the statement of revenues,expenditures,and changes in

Q17: Based on the information given above,what amount

Q18: Based on the preceding information,what will be

Q19: Partner A has a smaller capital balance

Q21: Based on the information given above,what was

Q26: If the functional currency is the local

Q27: Based on the preceding information,what amount will

Q34: Which of the following characteristics best describes

Q87: A private college received an offer from