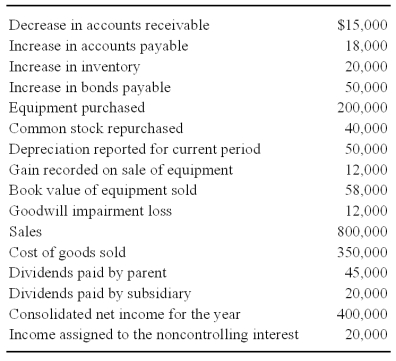

New Life Corporation has just finished preparing a consolidated balance sheet,income statement,and statement of changes in retained earnings for 2009.The following items are proposed for inclusion in the consolidated cash flow statement:

New Life holds 75 percent of the voting stock of Shane Pharmaceuticals,acquired at book value on June 21,2006.On the date of the acquisition,the fair value of the noncontrolling interest was equal to 25 percent of the book value of Shane.

-Based on the preceding information,what amount will be reported in the consolidated cash flow statement as net cash used in financing activities for 2009?

Definitions:

Discreet Approach

A method of implementing changes or segments within a business or project in a separate, distinct manner, often used to monitor the success or failure of initiatives independently.

IFRS

International Financial Reporting Standards, a set of accounting standards developed by the International Accounting Standards Board (IASB) that is globally accepted for financial reporting.

Long-term Debt

Borrowings of a company not due for repayment within the next 12 months, typically in the form of loans or bonds.

Operating Segment

A component of an enterprise engaged in business activities from which it may earn revenues and incur expenses, often reported separately in financial statements.

Q1: Davis Company uses LIFO for all of

Q3: Required:<br>Prepare the eliminating entries needed as of

Q6: Government-wide financial statements prepared for a municipality

Q11: Which of the following is true about

Q12: Based on the information given above,in the

Q23: Which of the following are examples of

Q24: Which of the following forms is the

Q29: "Red Herring" Prospectus

Q39: Which of the following statements concerning the

Q42: Comment Letter