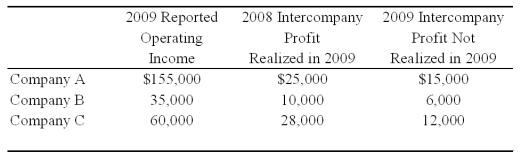

Company A owns 85 percent of Company B's stock and 80 percent of Company C's stock.All acquisitions were made at book value.The fair values of noncontrolling interests at the time of acquisition were equal to the proportionate share of the book values of the companies.The companies file a consolidated tax return each year and in 2009 paid a total tax of $112,000.Each company is involved in a number of intercompany inventory transfers each period.Information on the companies' activities for 2009 is as follows:

Company A does not record income tax expense on income from subsidiaries because a consolidated tax return is filed.

-Based on the information provided,income to the controlling interest for 2009 is:

Definitions:

Business Model Canvas

A visual chart with elements describing a firm's value proposition, infrastructure, customers, and finances, facilitating an understanding of a business model.

Entrepreneur

An individual who creates and manages a business venture with the aim of profit-making while taking on financial risk.

Business Model Canvas

A strategic management template for developing new or documenting existing business models visually.

Blocks

Obstacles or barriers that impede progress or prevent achievement of goals.

Q1: Refer to the information given above.What amount

Q3: Which of the following observations concerning "goodwill"

Q9: Roland Company acquired 100 percent of Garros

Q12: Based on the preceding information,what amount of

Q17: Based on the preceding information,what amount of

Q33: Locus Corporation acquired 80 percent ownership of

Q35: Based on the preceding information,what amount would

Q39: Based on the information given,what amount will

Q50: Based on the preceding information,what amount will

Q58: At the end of the fiscal year,uncollected