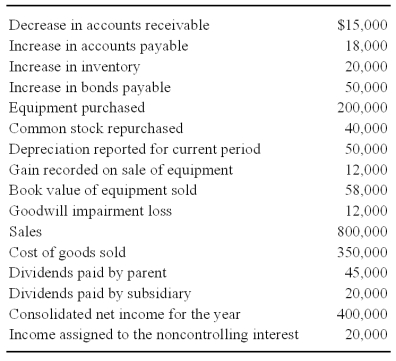

New Life Corporation has just finished preparing a consolidated balance sheet,income statement,and statement of changes in retained earnings for 2009.The following items are proposed for inclusion in the consolidated cash flow statement:

New Life holds 75 percent of the voting stock of Shane Pharmaceuticals,acquired at book value on June 21,2006.On the date of the acquisition,the fair value of the noncontrolling interest was equal to 25 percent of the book value of Shane.

-Based on the preceding information,what amount will be reported in the consolidated cash flow statement as net cash used in financing activities for 2009?

Definitions:

Delegable Duty

A responsibility or duty that can be transferred or assigned from one party to another, often seen in contexts of employment or contractual agreements.

Incidental Beneficiary

A third party who benefits from a contract between two other parties, although the benefit was not the reason the contract was formed.

Donee Beneficiary

A third party who benefits from a contract made between two other parties, particularly where the contract's intent is to gift something to the beneficiary.

Creditor Beneficiary

A third party that benefits from a contract in which one party promises to pay a debt owed to the third party by the other contract party.

Q1: Power Corporation owns 75 percent of Transmitter

Q3: Which of the following observations concerning "goodwill"

Q4: Based on the information given above,what percentage

Q19: On December 31,2008,Defoe Corporation acquired 80 percent

Q29: Based on the preceding information,Trevor Company's net

Q41: Senior Inc.owns 85 percent of Junior Inc.During

Q45: Based on the preceding information,what is the

Q46: Based on the preceding information,the amount of

Q64: The statement of changes in fiduciary net

Q186: "Stacking" in sports is the pattern by