The following transactions and information pertain to Lazar Corporation for 2009 and 2010.

2009

May 1 Purchased 3,000 shares of Ross Corporation common stock at per share (representing 5 percent of Ross's total outstanding stock) as a long-term investment.

Sept. 1 Received a cash dividend from Ross equal to per share.

Dec. 31 Market value of Ross stock at year end was per share.

2010

Sept. 1 Received a cash dividend from Ross equal to $.50 per share.

Nov. 1 Sold 400 shares of Ross at per share.

Dec. 31 Market value of Ross stock at vear end was per share.

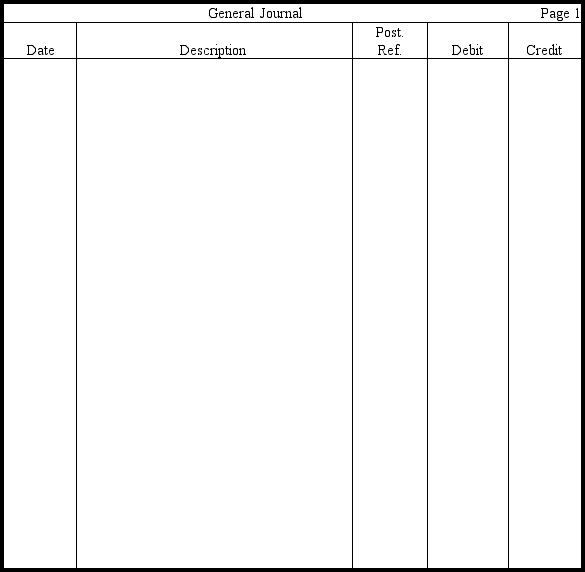

Prepare entries in journal form,without explanations,to record the above.Lazar's accounting year ends December 31.

Definitions:

Adverse Selection

A situation in which one party in a transaction has more or better information than the other, often leading to an undesirable outcome.

Underpriced

Describes a situation where the price of a good or service is set below its market value or cost of production.

Bulletin Board

A surface intended for the posting of public messages, notices, or advertisements.

Moral Hazard

The situation where one party to an agreement can take risks because they know they will not have to bear the full consequences of their actions.

Q6: Use the following information to obtain

Q12: Boris Corporation had income before income taxes

Q17: Accounting for a defined benefit pension plan

Q107: When the equity method is used to

Q112: Use this information to answer the following

Q116: The stockholders' equity section of Ernesto

Q134: Royer Corporation engaged in this transaction: Paid

Q140: Compensation expense related to employee stock option

Q140: Haskell,Inc.,reported the following income before income

Q159: When the straight-line method of amortization is