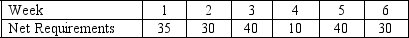

A company that makes construction equipment is exploring different lot sizing approaches to its MRP schedule: lot-for-lot (LFL), fixed order quantity (FOQ) using the EOQ, and period order quantity (POQ).It costs $100 to set up the production line to produce hydraulic jacks and the carrying cost per unit per week is $1.Annual demand is expected to be 1550 jacks.For planning purposes, the company uses a 50-week work year and disregards the effects of initial inventory and safety stock.The net requirements for hydraulic jacks for the next six weeks are:

a.Using a LFL approach, what is the lot size in week 3?

a.Using a LFL approach, what is the lot size in week 3?

b.What is the total cost for the LFL method?

c.What is the Fixed order quantity (FOQ) using the EOQ approach?

d.What is the beginning inventory for week 5 using the FOQ approach?

e.What is the total cost using the FOQ method?

f.What is the period order quantity?

g.What is the ending inventory for week 4 using the POQ method?

h.What is the total cost using the POQ approach?

Definitions:

Original Capital Investment

The initial sum of money invested in a business venture, project, or asset, used to start or acquire the investment.

Salary Allowances

Additional benefits or compensations provided to employees on top of their regular salary, which may include housing, transport, or medical allowances.

Liquidation

The process of closing a business and distributing its assets to claimants, often done when a company is insolvent.

Going Out Of Business

The process of closing a company permanently, often involving selling off assets and paying off creditors.

Q4: If single exponential smoothing is used and

Q8: The normal-time project cost does not depend

Q10: Which of the following is not a

Q13: Process layouts generally require less investment in

Q15: A Performance Rating Factor (PRF) of 130%

Q21: (Ending inventory from the previous month) +

Q42: Which type of layout is best for

Q43: If actual demand for a product is

Q45: A long-range forecast typically covers a planning

Q68: An exponential smoothing model can be found