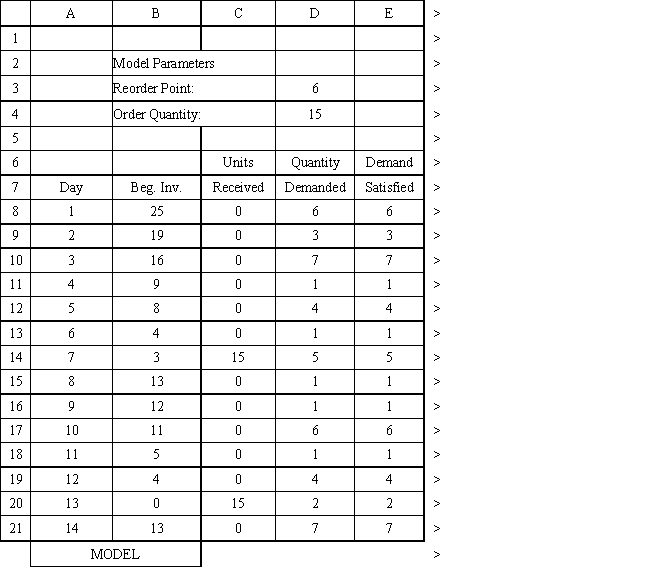

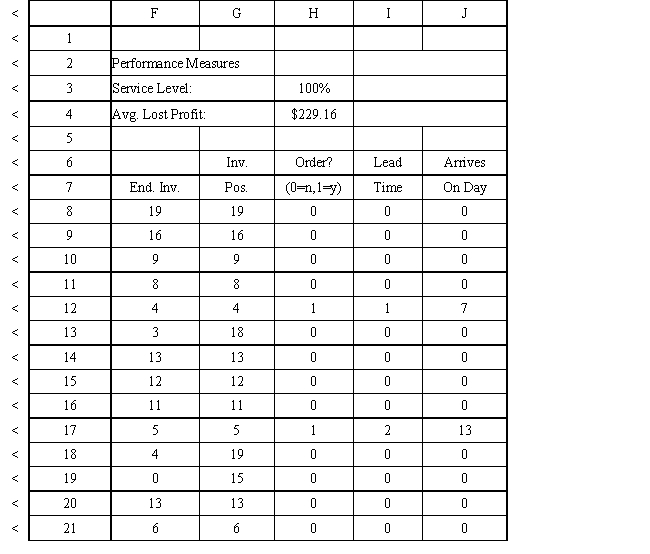

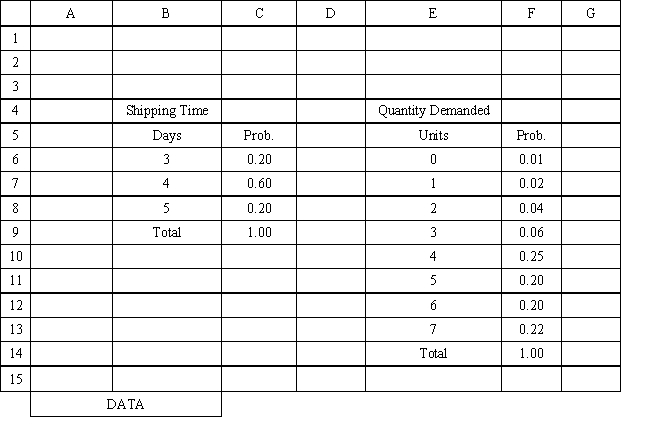

Exhibit 12.3

The following questions use the information below.

An auto parts store wants to simulate its inventory system for engine oil. The company has collected data on the shipping time for oil and the daily demand for cases of oil. A case of oil generates a $10 profit. Customers can buy oil at any auto parts store so there are no backorders (the company loses the sale and profit) . The company orders 30 cases whenever the inventory position falls below the reorder point of 15 cases. Orders are placed at the beginning of the day and delivered at the beginning of the day so the oil is available on the arrival day. An average service level of 99% is desired. The following spreadsheets have been developed for this problem. The company has simulated 2 weeks of operation for their inventory system. The current level of on-hand inventory is 25 units and no orders are pending.

-Using the information in Exhibit 12.3, what Analytic Solver Platform function should be used in cell I8 to determine the lead time for an order?

Definitions:

Perfect Competitor

A market structure where many firms offer products or services that are similar, allowing for free entry and exit, and no single firm can influence the market price.

Imperfect Competitor

An entity in a market that does not hold enough power to dictate the conditions of the market but can influence the price and output of its goods to some extent.

MRP

Marginal Revenue Product, the additional revenue generated from employing one more unit of a factor of production.

Unit of Input

The smallest measure of an input (like labour, materials) used in the production of goods or services.

Q15: A security has a price of $3,000

Q23: A mechanism by which a short-term loan

Q39: Refer to Exhibit 11.8.What formula should be

Q53: Which of the following is false regarding

Q66: A company wants to locate a new

Q70: Refer to Exhibit 10.1.How many observations are

Q76: Refer to Exhibit 11.7.What formula should be

Q78: The standard prediction error is<br>A)always smaller than

Q95: What is the formula for the exponential

Q95: The probabilities of different returns on