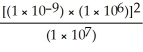

Without using a calculator,solve the following problem:

Definitions:

Risk Premium

The extra return expected by an investor for holding a higher-risk investment over a risk-free asset.

Factor Portfolios

Investment portfolios constructed to have a high sensitivity to certain factors or characteristics expected to yield higher returns, such as size, value, or momentum.

Pricing Model

A theoretical approach used to determine the price of a financial instrument or the valuation of a company.

Risk-Free Rate

The risk-free rate is the theoretical rate of return of an investment with zero risk, serving as a benchmark for measuring financial instruments' risk.

Q4: Trust preferred stock:<br>A)does not pay any dividends<br>B)has

Q10: A portfolio is equally invested in securities

Q11: Historically, what has prevented universal banks from

Q15: The default risk associated with loans made

Q35: Discuss the advantages and disadvantages of a

Q43: What are STRIPS and what do banks

Q43: A bank that holds only U.S.Treasury securities

Q74: Identify the smallest subatomic particle.<br>A) a neutron<br>B)

Q131: Identify the compound with ionic bonds.<br>A) Ne<br>B)

Q172: What is the structure of the covalent