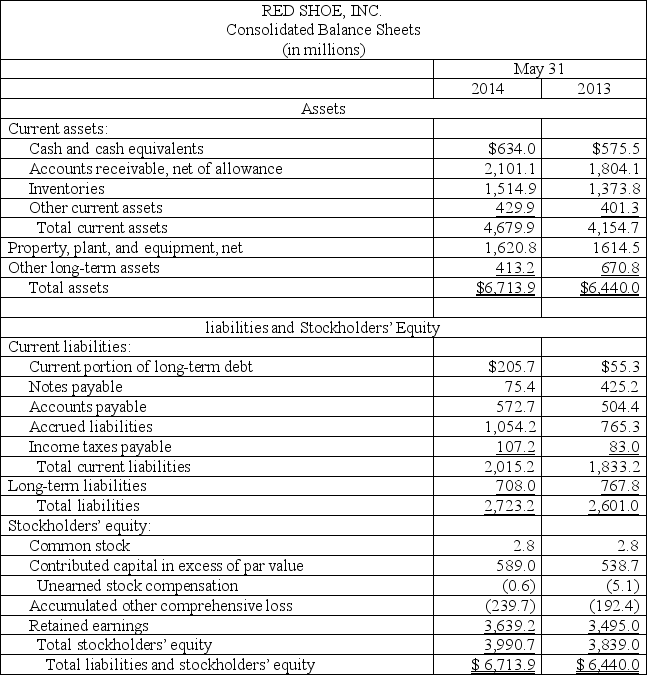

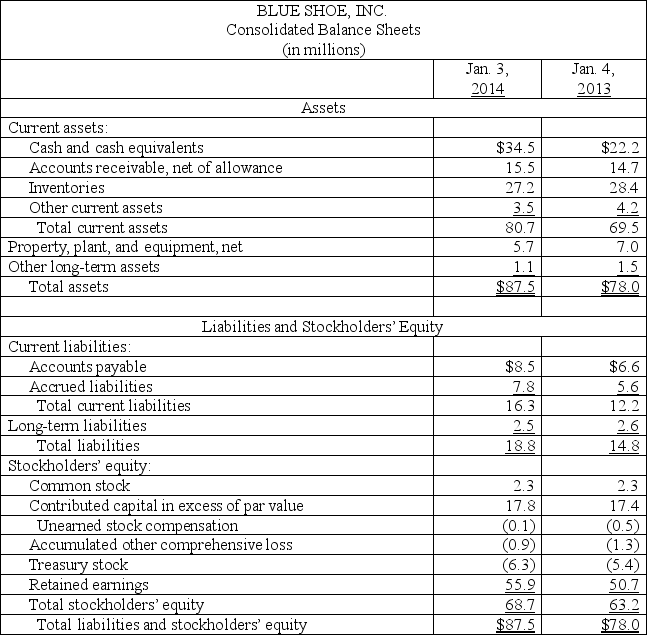

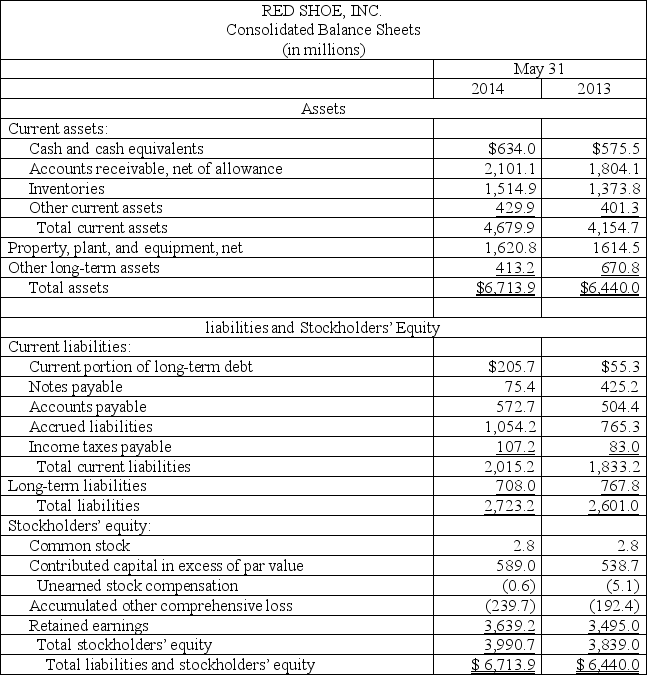

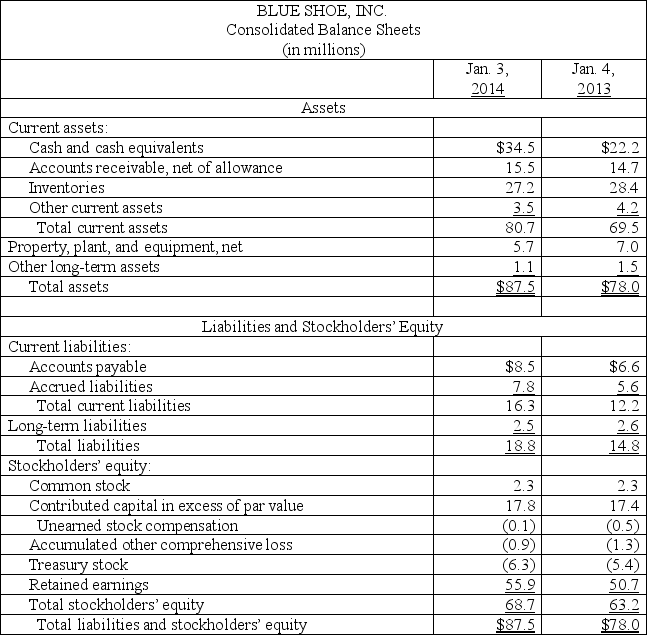

The following are summaries from the income statements and balance sheets of Red Shoe,Inc.and Blue Shoe,Inc.

RED SHOE, INC.Consolidated Statement of IncomeMay 31,2014(in millions) Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense Other revenues and expenses Income before tax Income taxes Income before effect of accounting change Cumulative effect of accounting change, net of tax Net income $10,697.06,313.64,383.43,137.61,245.842.979.91,123.0382.9740.1266.1$474.0

BLUE SHOE, INC.Consolidated Statement of Income January 3, 2014(in millions) Revenues Cost of sales Gross profit Operating expenses Operating income Interest expense Other revenues and expenses Income before tax Income taxes Net income $133.587.346.237.38.9(0.1)0.39.13.9$5.2

(1)For both companies compute the following ratios for 2014:

(a)Current ratio

(b)Acid-test ratio

(c)Accounts receivable turnover

(d)Inventory turnover

(e)Days' sales in inventory

(f)Days' sales uncollected

Which company do you consider to be the better short-term credit risk? Explain.

(2)For both companies compute the following ratios for 2014:

(a)Profit margin ratio

(b)Return on total assets

(c)Return on common stockholders' equity

Which company do you consider to have better profitability ratios?

Identify and describe the factors influencing population distribution and dispersion patterns.

Describe and understand the logistic growth model and its assumptions.

Understand the concept of life history traits and strategies in different organisms.

Recognize density-dependent and density-independent factors affecting population sizes.

Definitions:

Bond

A fixed income investment in which an investor loans money to an entity (corporate or governmental) which borrows the funds for a defined period at a variable or fixed interest rate.

Financial Asset

An intangible asset that derives value from a contractual right or ownership claim, such as stocks, bonds, or bank deposits.

Company's Profits

The financial gain realized when the revenues generated from business activities exceed the expenses, costs, and taxes needed to sustain the activities.

Interest

The cost of borrowing money or the return earned on an investment, typically expressed as a percentage.