REFERENCE: Ref.09_03 Car Corp.(a U.S.-Based Company)sold Parts to a Korean Customer on Customer

REFERENCE: Ref.09_03

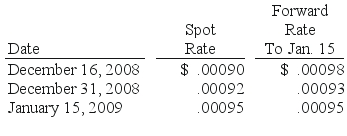

Car Corp.(a U.S.-based company) sold parts to a Korean customer on December 16,2008,with payment of 10 million Korean won to be received on January 15,2009.The following exchange rates applied:

SHAPE \* MERGEFORMAT

-Assuming a forward contract was entered into,what would be the net impact on Car Corp.'s 2008 income statement related to this transaction? Assume an annual interest rate of 12% and a fair value hedge.The present value for one month at 12% is .9901.

Definitions:

Spot Rates

The existing selling or buying price of a certain asset that is ready for instant delivery.

IFRS 9

International Financial Reporting Standard 9, dictating the accounting for financial instruments, including recognition, measurement, and impairment of assets.

Accounts Receivable

Money owed to a business by its clients or customers for goods or services delivered or used but not yet paid for.

Hedge

An investment made to reduce the risk of adverse price movements in an asset, typically involving taking an offsetting position in a related security.

Q12: All of the following are required to

Q26: Assuming Baker makes the change in the

Q45: The production possibilities frontier illustrates<br>A) the combinations

Q50: Suppose Bob and Tom are writing jokes

Q76: Which of the following would most likely

Q83: What was the noncontrolling interest in Boat

Q92: The statement that "at 10 percent,the interest

Q100: Which of the segments are separately reportable?<br>A)DVDs

Q118: The distinction between positive and normative economics<br>A)

Q134: The opportunity cost of a particular economic