REFERENCE: Ref.09_04 on December 1,2007,Keenan Company,a U.S.firm,sold Merchandise to Velez Company of Company

REFERENCE: Ref.09_04

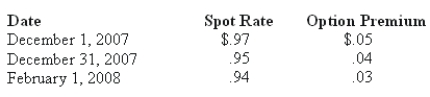

On December 1,2007,Keenan Company,a U.S.firm,sold merchandise to Velez Company of Spain for 150,000 euro.Payment is due on February 1,2008.Keenan entered into a forward exchange contract on December 1,2007,to deliver 150,000 euro on February 1,2008 for $.97.Keenan chose to use a foreign currency option to hedge this foreign currency asset designated as a cash flow hedge.Relevant exchange rates follow:

-Alpha,Inc. ,a U.S.company,had a receivable from a customer that was denominated in pesos.On December 31,2008,this receivable for 75,000 pesos was correctly included in Alpha's balance sheet at $8,000.The receivable was collected on March 2,2009,when the U.S.equivalent was $6,900.How much foreign exchange gain or loss will Alpha record on the income statement for the year ended December 31,2009?

Definitions:

Status Quo Bias

The preference for maintaining current conditions or resisting change, even when better alternatives exist.

Anchoring Effect

A cognitive bias where an individual depends too heavily on an initial piece of information (the "anchor") when making decisions.

Endowment Effect

A psychological inclination to value possessions more highly solely due to personal ownership.

Endowment Effect

A mental occurrence in which individuals attribute increased worth to objects simply because they possess them.

Q32: Economic models do not have to completely

Q40: Lawrence Company,a U.S.company,ordered parts costing 1,000,000 Thailand

Q43: What is the balance in Noncontrolling Interest

Q75: Using the information in Figure 2-11,Jill's opportunity

Q76: What journal entry should Eagle prepare on

Q76: If a society is on its production

Q91: If the president of Chile commented that

Q96: What is the minimum amount of profit

Q105: If the price of film increases,the demand

Q114: Suppose that initially the market for DVDs