REFERENCE: Ref.09_10 on October 1,2007,Eagle Company Forecasts the Purchase of Inventory from Inventory

REFERENCE: Ref.09_10

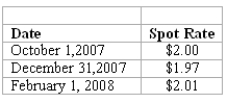

On October 1,2007,Eagle Company forecasts the purchase of inventory from a British supplier on February 1,2008,at a price of 100,000 British pounds.On October 1,2007,Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound.The option is considered to be a cash flow hedge of a forecasted foreign currency transaction.On December 31,2007,the option has a fair value of $1,600.The following spot exchange rates apply:

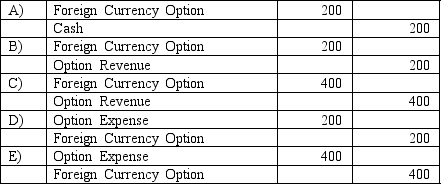

-What journal entry should Eagle prepare on December 31,2007?

Definitions:

Ambivalent

Having mixed feelings or contradictory ideas about something or someone.

Dental Hygienist

A licensed dental professional specializing in preventive oral health, typically focusing on techniques in oral hygiene.

Ambivalent Attachment

The attachment style for infants who are unwilling to explore an unfamiliar environment but seem to have mixed feelings about the caregiver—they cry when the caregiver leaves the room, but they cannot be consoled by the caregiver upon the caregiver’s return.

Secure

Feeling of being safe, stable, and free from fear or anxiety.

Q4: Prescott Corp.owned 90% of Bell Inc. ,while

Q7: For each of the following situations (1

Q15: What happens when a U.S.company purchases goods

Q18: What amount should have been reported for

Q36: In a traditional economy,decisions about what to

Q65: Net cash flow from operating activities was:<br>A)$44,000.<br>B)$44,800.<br>C)$46,200.<br>D)$50,000.<br>E)$52,200.

Q74: Assume that U.S.agricultural land is used either

Q81: Stahl Corporation owns 80 percent of the

Q84: What amount of foreign exchange gain or

Q145: Suppose that an economy produces civilian goods