REFERENCE: Ref.09_08

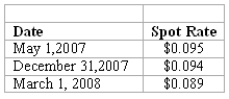

On May 1,2007,Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos.The machine was shipped and payment was received on March 1,2008.On May 1,2007,Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1,2008 at a price of $190,000.Mosby properly designates the option as a fair value hedge of the peso firm commitment.The option cost $3,000 and had a fair value of $3,200 on December 31,2007.The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12 percent,and the present value factor for two months at a 12 percent annual rate is .9803.

Mosby's incremental borrowing rate is 12 percent,and the present value factor for two months at a 12 percent annual rate is .9803.

-What was the net impact on Mosby's 2008 income as a result of this fair value hedge of a firm commitment?

Definitions:

Stratum Granulosum

A layer in the epidermis situated between the stratum corneum and stratum spinosum, involved in the process of keratinization.

Keratin

A type of protein found in the hair, nails, and outer layer of the skin, which provides protection and strength.

Accessory Structures

Structures that are not vital for the body to function but support or assist the role of major organs or systems.

Dense Irregular Connective

A type of connective tissue with collagen fibers arranged in a disorganized pattern, providing strength and resistance in various directions.

Q9: How much foreign exchange gain or loss

Q11: What is the minimum amount of assets

Q77: With regard to the intercompany sale,which of

Q92: What is the minimum amount of revenue

Q95: The basic problem of economics arises when

Q98: The supply and demand model<br>A) tries to

Q99: Which of the following disciplines is not

Q99: A company had common stock with a

Q126: The principle of comparative advantage says that<br>A)

Q137: Excess demand occurs when<br>A) the actual price