REFERENCE: Ref.09_10 on October 1,2007,Eagle Company Forecasts the Purchase of Inventory from Inventory

REFERENCE: Ref.09_10

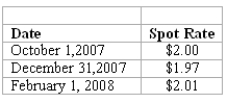

On October 1,2007,Eagle Company forecasts the purchase of inventory from a British supplier on February 1,2008,at a price of 100,000 British pounds.On October 1,2007,Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound.The option is considered to be a cash flow hedge of a forecasted foreign currency transaction.On December 31,2007,the option has a fair value of $1,600.The following spot exchange rates apply:

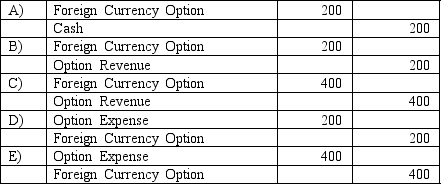

-What journal entry should Eagle prepare on December 31,2007?

Definitions:

QuickBooks Lists

Features within QuickBooks software that organize data into manageable categories like vendors, customers, and inventory items for easy access and management.

Opening Balance

The opening balance is the amount of funds in an account at the start of a new accounting period, carried over from the end of the previous period.

New Account

The initial setup or registration of an account in a financial system or online service.

Account Options

Various choices available to users for setting up, managing, and customizing their financial accounts within a software or service.

Q2: What is the total amount of goodwill

Q3: Characterizing a market involves<br>A) counting the number

Q31: Which operating segments are separately reportable under

Q33: What is the minimum amount of revenue

Q47: If the supply curve does not shift,an

Q83: Assume that U.S.agricultural land is used either

Q100: Compute Whitton's accrual-based consolidated net income for

Q106: What will be reported as the noncontrolling

Q110: Which of the following is not correct

Q126: The principle of comparative advantage says that<br>A)