REFERENCE: Ref.09_09

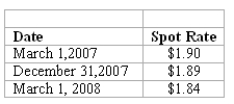

On March 1,2007,Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds.The machine was shipped and payment was received on March 1,2008.On March 1,2007,Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1,2008 at a price of $380,000.Mattie properly designates the option as a fair hedge of the pound firm commitment.The option cost $2,000 and had a fair value of $2,200 on December 31,2007.The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12 percent,and the present value factor for two months at a 12 percent annual rate is .9803.

Mattie's incremental borrowing rate is 12 percent,and the present value factor for two months at a 12 percent annual rate is .9803.

-What was the net impact on Mattie's 2007 income as a result of this fair value hedge of a firm commitment?

Definitions:

Evolutionary Principles

The fundamental concepts underlying the theory of evolution, including natural selection, adaptation, and the survival of the fittest.

Aphasia

A disorder caused by damage to parts of the brain responsible for language, affecting speaking, reading, writing, or understanding language.

Prefrontal Cortex

The front part of the frontal lobes of the brain, involved in complex cognitive behavior, personality expression, decision making, and moderating social behavior.

Executive Functioning

A set of cognitive processes including working memory, flexible thinking, and self-control, that are necessary for managing oneself and one's resources to achieve a goal.

Q5: On November 8,2009,Power Corp.sold land to Wood

Q6: Belsen purchased inventory on December 1,2008.Payment of

Q12: How much will the consolidated group save

Q38: Angela,Inc. ,a U.S.company,had a euro receivable from

Q74: Compute the noncontrolling interest in net income

Q76: Which of the following would most likely

Q83: Compute the value of the foreign currency

Q97: Where do intercompany sales of inventory appear

Q120: During the early years of the US

Q142: If capital is not being used efficiently,an