REFERENCE: Ref.09_11 Coyote Corp.(a U.S.company in Texas)had the Following Series of Transactions

REFERENCE: Ref.09_11

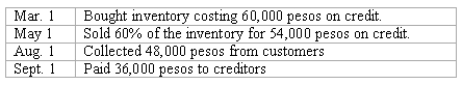

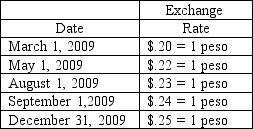

Coyote Corp.(a U.S.company in Texas)had the following series of transactions in a foreign country during 2009.The appropriate exchange rates during 2009 were as follows:  The appropriate exchange rates during 2009 were as follows:

The appropriate exchange rates during 2009 were as follows:

-What amount will Coyote Corp.report on its 2009 financial statements for Sales?

Definitions:

Volatility Risk

The risk in the value of options portfolios due to unpredictable changes in the volatility of the underlying asset.

Hedge Ratio

A ratio used to measure the proportion of a position that is hedged or the amount of assets used to hedge a risk exposure.

Dynamic Hedging

Constant updating of hedge positions as market conditions change.

Delta Neutral

The value of the options portfolio is not affected by changes in the value of the underlying asset.

Q7: All the problems studied in economics arise

Q14: The specialization of labor<br>A) leads to a

Q39: As a society produces more and more

Q40: Which of the following explains why individuals

Q71: What amount will Coyote Corp.report on its

Q99: A decrease in equilibrium price and an

Q108: What ownership structure is referred to as

Q118: Bill can cook dinner in 45 minutes

Q133: Normative economics deals with<br>A) how the economy

Q135: Microeconomics analyzes individual parts of the economy