REFERENCE: Ref.08_10

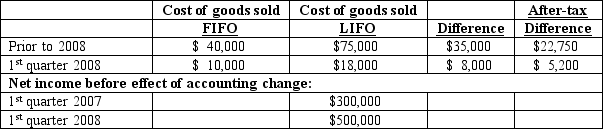

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2008.Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding.The following additional information is available:

-Assuming Baker makes the change in the first quarter of 2008 and that $400,000 net income is earned during the second quarter,how much is reported as net income for the second quarter of 2008?

Definitions:

Personal Contact

involves direct interaction between individuals, usually face-to-face, for communication or relationship building.

Distress

Extreme anxiety, sorrow, or pain that negatively impacts an individual's mental and physical well-being.

Uberstress

An extreme or overwhelming level of stress that can negatively impact one's health and well-being.

Stressors

External events or circumstances that may cause physical, emotional, or psychological strain or tension.

Q6: For each of the following situations,select the

Q26: Even though households may have unlimited wants,they

Q28: How much income tax expense is recognized

Q29: What was the amount of income tax

Q62: Which of the following statements is true

Q76: What journal entry should Eagle prepare on

Q82: Required:<br>Prepare a schedule to show consolidated net

Q87: Suppose Bob and Tom are writing jokes

Q105: Britain Corporation acquires all of English,Inc.for $800,000

Q120: Because economists have different values,like everyone else,they<br>A)