REFERENCE: Ref.08_14 Harrison Company,Inc.began Operations on January 1,2008,and Applied the LIFO Method

REFERENCE: Ref.08_14

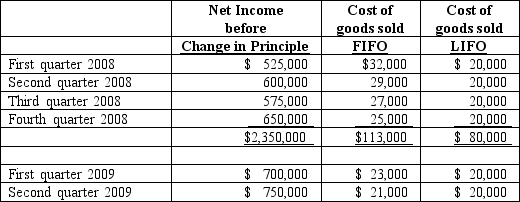

Harrison Company,Inc.began operations on January 1,2008,and applied the LIFO method for inventory valuation.On June 10,2009,Harrison adopted the FIFO method of accounting for inventory.Additional information is as follows:

The LIFO method was applied during the first quarter of 2009 and the FIFO method was applied during the second quarter of 2009 in computing income,above.Harrison's effective income tax rate is 40 percent.Harrison has 500,000 shares of common stock outstanding at all times.

The LIFO method was applied during the first quarter of 2009 and the FIFO method was applied during the second quarter of 2009 in computing income,above.Harrison's effective income tax rate is 40 percent.Harrison has 500,000 shares of common stock outstanding at all times.

-Prepare a schedule showing the calculation of net income and earnings per share to be reported by Harrison for the three-month period and the six-month period ended June 30,2008 and 2009.

Definitions:

Q10: Economists disagree about many things.When those disagreements

Q19: On January 1,2009,Race Corp.acquired 80% of the

Q20: Gaw Produce Co.purchased inventory from a Japanese

Q41: Required:<br>Determine the noncontrolling interest in Lawrence Co.'s

Q48: During 2009,Parent Corporation purchased at book value

Q71: Compute the gain on transfer of equipment

Q88: A U.S.company buys merchandise from a foreign

Q94: If the combination transaction had taken place

Q103: In Cale's accounting records,what amount would appear

Q161: Which if the following is a normative