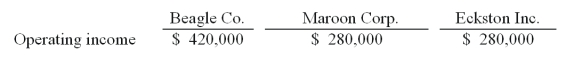

Beagle Co. owned 80% of Maroon Corp. Maroon owned 90% of Eckston Inc. Operating income totals for 2011 are shown below; these figures contained no investment income. Amortization expense was not required by any of these acquisitions. Included in Eckston's operating income was a $56,000 unrealized gain on intra-entity transfers to Maroon.

-The accrual-based income of Eckston Inc. is calculated to be

Definitions:

Unlawful Gambling

Participation in betting or wagering activities that are not authorized by law.

Prosecuted

refers to the act of bringing a legal action against an individual or entity for a crime or violation of law, typically pursued by the state or government.

U.S. Constitution

The supreme law of the United States of America, consisting of a preamble, seven articles that delineate the national frame of government, and amendments.

Q4: List the five aggregation criteria that need

Q14: Prepare the profit or loss test to

Q16: Kordel Inc.holds 75% of the outstanding common

Q51: Production is productively efficient when<br>A) the maximum

Q58: When a company has preferred stock in

Q63: What ownership pattern is referred to as

Q77: The study of economics would be superfluous

Q93: Describe how this transaction would affect Panton's

Q97: What is the total of consolidated operating

Q112: In one hour,George can fix 4 flat