REFERENCE: Ref.05_02 On January 1,2009,Pride,Inc.bought 80% of the Outstanding Voting Common Stock

REFERENCE: Ref.05_02

On January 1,2009,Pride,Inc.bought 80% of the outstanding voting common stock of Strong Corp.for $364,000.Of this payment,$28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000.Any remaining excess was attributable to goodwill which has not been impaired.

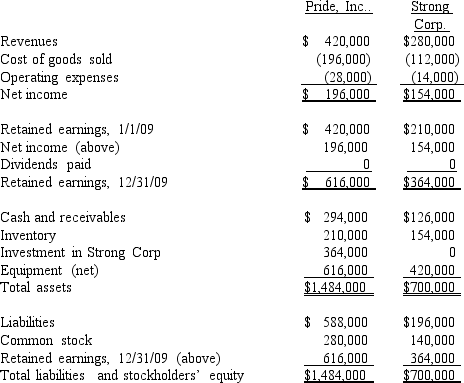

As of December 31,2009,before preparing the consolidated worksheet,the financial statements appeared as follows:

During 2009,Pride bought inventory for $112,000 and sold it to Strong for $140,000.Only half of this purchase had been paid for by Strong by the end of the year.60% of these goods were still in the company's possession on December 31.

During 2009,Pride bought inventory for $112,000 and sold it to Strong for $140,000.Only half of this purchase had been paid for by Strong by the end of the year.60% of these goods were still in the company's possession on December 31.

-What is the total of consolidated operating expenses?

Definitions:

Stem Cells

Undifferentiated cells that have the potential to develop into different cell types, used in medical research and treatment.

Differentiate

To recognize or ascertain what makes someone or something distinct or different compared to others.

Cellular Signaling

The complex system of communication that governs basic cellular activities and coordinates cell actions, crucial for the body's functioning and response to the environment.

Differentiation

Involves the process of becoming distinct or specialized in structure or function, often used in the context of cells in biology or elements within a system.

Q17: Which of the following are required to

Q27: In consolidation at January 1,2009,what adjustment is

Q31: When a parent uses the initial value

Q40: What is Ryan's percent ownership in Chase

Q45: Historically,what was the pattern of reporting of

Q62: At the end of 2009,the consolidation entry

Q69: In settling an estate,what is the meaning

Q83: Assuming the combination is accounted for as

Q89: Pursley,Inc.owns 70 percent of Harry,Inc.The consolidated income

Q103: Compute Cody's undistributed earnings for 2009.<br>A)$62,500.<br>B)$125,000.<br>C)$87,500.<br>D)$100,000.<br>E)$70,000.