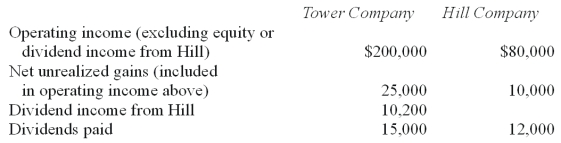

Tower Company owns 85% of Hill Company. The two companies engaged in several intra-entity transactions. Each company's operating and dividend income for the current time period follow, as well as the effects of unrealized gains. No income tax accruals have been recognized within these totals. The tax rate for each company is 30%.

-Under the separate return method, how much income tax expense will be assigned to Hill?

Definitions:

Thomas Robert Malthus

An English cleric and scholar, influential in the fields of political economy and demography, known for his theory on population growth.

Standard of Living

The standard of living refers to the degree of wealth, comfort, material goods, and necessities available to a person or community.

Saving Rate

The portion of income that is not spent on consumption but instead is saved or invested.

Aggregate Demand

The sum of all expenditures for goods and services.

Q8: Compute the consideration transferred in excess of

Q36: In accounting for an acquisition using the

Q39: The objective of an economic model is

Q47: Compute the gain or loss on the

Q60: Which of the following statements is true

Q64: Compute the income from Devin reported on

Q70: What is the controlling interest share of

Q77: Which of the following is not an

Q112: If this combination is viewed as an

Q134: Referring to Figure 2-13,if you had to