REFERENCE: Ref.07_17 On January 1,2009,Maurice Co.acquired 75% of Lawrence Co.'s Outstanding Common

REFERENCE: Ref.07_17

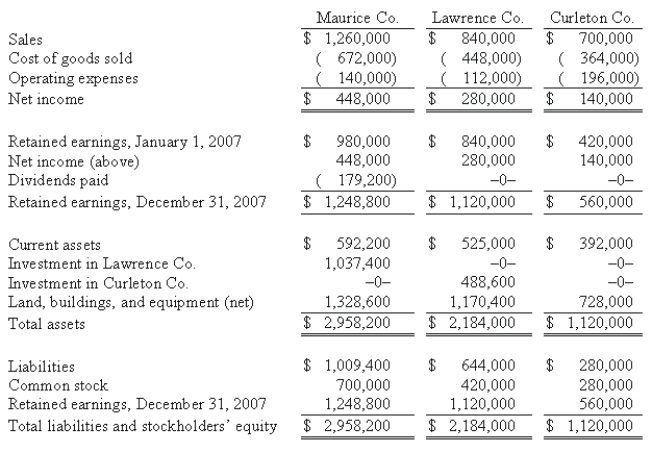

On January 1,2009,Maurice Co.acquired 75% of Lawrence Co.'s outstanding common stock.On the same date,Lawrence acquired an 80% interest in Curleton Co.Both of these investments were accounted using the initial value method.No dividends were distributed by either Lawrence or Curleton during 2009 or 2010.Maurice paid cash dividends each year equal to 40% of operating income.Reported operating income totals for 2009 were as follows:  Following are the 2010 financial statements for these three companies.Curleton made numerous transfers of inventory to Lawrence since the takeover: $112,000 (2009)and $140,000 (2010).These transactions included the same markup applicable to Curleton's outside sales.In each of these years,Lawrence carried 20% of this inventory into the succeeding year before disposing of it.

Following are the 2010 financial statements for these three companies.Curleton made numerous transfers of inventory to Lawrence since the takeover: $112,000 (2009)and $140,000 (2010).These transactions included the same markup applicable to Curleton's outside sales.In each of these years,Lawrence carried 20% of this inventory into the succeeding year before disposing of it.

An effective income tax rate of 45% was applicable to all companies.

I can't edit picture.Need to change the three years in the schedules - each from 2007 to 2010  The years should be 2010 instead of 2007 in this table

The years should be 2010 instead of 2007 in this table

-Required:

Determine the noncontrolling interest in Curleton Co.'s net income.

Definitions:

Agricultural Price Supports

Government interventions to stabilize or increase agricultural commodity prices through various mechanisms such as subsidies or purchase commitments.

Marginal Cost

The additional cost incurred by producing one more unit of a product.

Rent-seeking

It involves seeking to increase one's share of existing wealth without creating new wealth, often through manipulation or exploitation of the economic environment.

Public Choice Theory

An economic theory that applies principles of economics to analyze political behavior and decision-making.

Q5: What is the amount of option expense

Q7: All the problems studied in economics arise

Q10: Assumiing the combination is accounted for as

Q15: A statutory merger is a(n)<br>A)business combination in

Q30: What is the net effect of the

Q33: What is the minimum amount of revenue

Q47: Compute the gain or loss on the

Q55: Opportunity costs exist because<br>A) there is a

Q65: Compute the value of the foreign currency

Q103: Assuming Involved's accounts are correctly valued within