REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

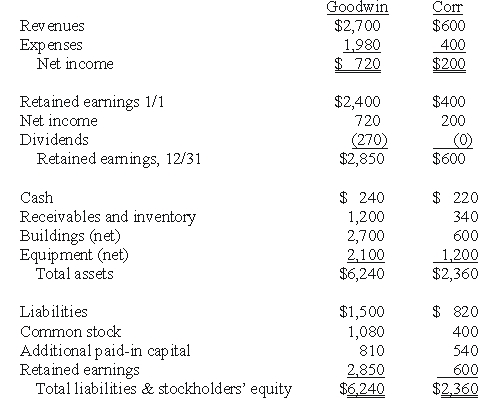

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Assumiing the combination is accounted for as a purchase,compute the consolidated retained earnings at December 31,20X1.

Definitions:

Population Means

The average of a set of measurements, scores, or values for the entire population.

Pooled Variance

An estimate of the common variance of two or more groups that is weighted by the degrees of freedom of each group.

Standard Error

The standard deviation of the sampling distribution of a statistic, often used to quantify the accuracy of a sample mean.

Independent Samples

Samples from different populations in which the selection of one sample does not influence or affect the selection of the other sample.

Q9: What amount of goodwill should be attributed

Q9: The estate of Bobbi Jones has the

Q15: What is the adjusted book value of

Q16: What is the main source of financial

Q22: Which of the following types of health

Q44: Prepare all consolidation entries for 2009.

Q48: The marshaling of assets doctrine regulates claims

Q48: Elon Corp.purchased all of the common stock

Q98: What amount will be reported for consolidated

Q103: What is the difference in consolidated results