REFERENCE: Ref.07_17 On January 1,2009,Maurice Co.acquired 75% of Lawrence Co.'s Outstanding Common

REFERENCE: Ref.07_17

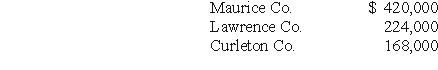

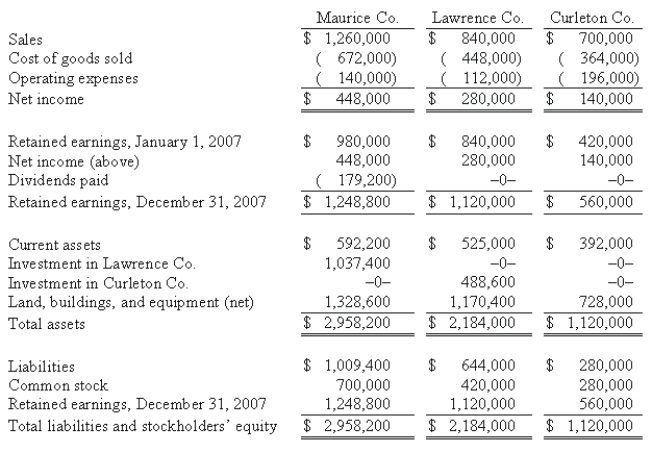

On January 1,2009,Maurice Co.acquired 75% of Lawrence Co.'s outstanding common stock.On the same date,Lawrence acquired an 80% interest in Curleton Co.Both of these investments were accounted using the initial value method.No dividends were distributed by either Lawrence or Curleton during 2009 or 2010.Maurice paid cash dividends each year equal to 40% of operating income.Reported operating income totals for 2009 were as follows:  Following are the 2010 financial statements for these three companies.Curleton made numerous transfers of inventory to Lawrence since the takeover: $112,000 (2009)and $140,000 (2010).These transactions included the same markup applicable to Curleton's outside sales.In each of these years,Lawrence carried 20% of this inventory into the succeeding year before disposing of it.

Following are the 2010 financial statements for these three companies.Curleton made numerous transfers of inventory to Lawrence since the takeover: $112,000 (2009)and $140,000 (2010).These transactions included the same markup applicable to Curleton's outside sales.In each of these years,Lawrence carried 20% of this inventory into the succeeding year before disposing of it.

An effective income tax rate of 45% was applicable to all companies.

I can't edit picture.Need to change the three years in the schedules - each from 2007 to 2010  The years should be 2010 instead of 2007 in this table

The years should be 2010 instead of 2007 in this table

-Required:

Determine the accrual-based income of Maurice Co.

Definitions:

Extraordinary Returns

Profits that significantly exceed the norm or benchmark, often due to unusual or rare events affecting the investment.

Net Present Values

The calculation that compares the value of all cash inflows and outflows of a project or investment using a discount rate to determine if it will yield a positive return.

Historical Record

Documentation or archives of past events, transactions, or values, often used for reference.

Small Stocks

Shares of companies with relatively small market capitalization.

Q30: When Buckette prepared consolidated financial statements,it should

Q32: What is the adjusted book value of

Q64: Prepare the asset test to determine which

Q72: Which statement is true regarding a foreign

Q91: Assuming the combination is accounted for as

Q100: Describe how this transaction would affect Panton's

Q100: Assuming the combination is accounted for as

Q104: Which of the following statements is false

Q107: In applying the asset test,what is the

Q120: What amount will be reported for consolidated