REFERENCE: Ref.06_03

These questions are based on the following information and should be viewed as independent situations.

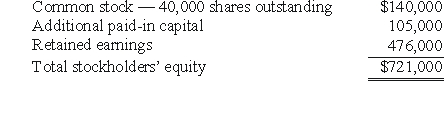

Popper Co.purchased 80% of the common stock of Cocker Co.on January 1,2004,when Cocker had the following stockholders' equity accounts.  To acquire this interest in Cocker,Popper paid a total of $682,000 with any excess cost being allocated to goodwill,which has been measured for impairment annually and has not been determined to be impaired as of January 1,2009.

To acquire this interest in Cocker,Popper paid a total of $682,000 with any excess cost being allocated to goodwill,which has been measured for impairment annually and has not been determined to be impaired as of January 1,2009.

On January 1,2009,Cocker reported a net book value of $1,113,000 before the following transactions were conducted.Popper uses the equity method to account for its investment in Cocker,thereby reflecting the change in book value of Cocker.

-On January 1,2009,Cocker issued 10,000 additional shares of common stock for $35 per share.Popper acquired 8,000 of these shares.How would this transaction affect the additional paid-in capital of the parent company?

Definitions:

Major Questions

Major questions are significant or fundamental inquiries aimed at understanding core aspects of a subject or issue.

Observe

To attentively watch or monitor something or someone using the senses, especially sight.

Conducting

The act of directing a musical performance by coordinating the tempo, dynamics, and expression of an ensemble.

Introspection

The act of scrutinizing or watching one's own mental and emotional activities.

Q1: The term capital,as used by economists,refers to<br>A)

Q1: Webb Co.acquired 100% of Rand Inc.on January

Q9: How much foreign exchange gain or loss

Q14: Economic models are used primarily to<br>A) predict

Q31: Cadion Co.owned control over Knieval Inc.Cadion reported

Q53: Compute the income from Gargiulo reported on

Q62: At the end of 2009,the consolidation entry

Q64: Compute the goodwill recognized in consolidation.<br>A)$800,000<br>B)$310,000.<br>C)$124,000.<br>D)$0.<br>E)$(196,000).

Q69: Alpha,Inc. ,a U.S.company,had a receivable from a

Q98: Parent sold land to its subsidiary for