REFERENCE: Ref.05_05 Gargiulo Company,a 90% Owned Subsidiary of Posito Corporation,sells Inventory to Inventory

REFERENCE: Ref.05_05

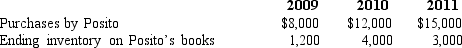

Gargiulo Company,a 90% owned subsidiary of Posito Corporation,sells inventory to Posito at a 25% profit on selling price.The following data are available pertaining to intercompany purchases.Gargiulo was acquired on January 1,2009.

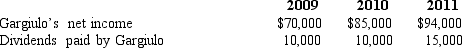

Assume the equity method is used.The following data are available pertaining to Gargiulo's income and dividends.

Assume the equity method is used.The following data are available pertaining to Gargiulo's income and dividends.

-Compute the income from Gargiulo reported on Posito's books for 2011.

Definitions:

Selling Commission

A fee paid to a salesperson or agent for facilitating a sale, typically a percentage of the sale price.

Operating Leverage

A measure of how revenue growth translates into growth in operating income, indicating the proportion of fixed versus variable costs a company has.

Variable Expenses

Expenses that fluctuate with changes in production volume or business activity levels, including materials, labor, and utilities.

Contribution Margin

The difference between sales revenue and variable costs, used to cover fixed costs and contribute to profit.

Q5: Yules Co.acquired Noel Co.in an acquisition transaction.Yules

Q8: When defining a reportable segment,which of the

Q22: Which of the following characteristics is not

Q29: Prepare the journal entries to reflect the

Q45: What is consolidated current liabilities as of

Q46: The opportunity cost of an economic action

Q62: According to SFAS 131,how should common costs

Q74: Compute consolidated expenses at date of acquisition.<br>A)$2,760.<br>B)$3,380.<br>C)$2,770.<br>D)$2,735.<br>E)$2,785.

Q81: Which two items of information must be

Q88: What is the noncontrolling interest in Gamma's