REFERENCE: Ref.06_03

These questions are based on the following information and should be viewed as independent situations.

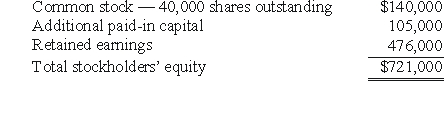

Popper Co.purchased 80% of the common stock of Cocker Co.on January 1,2004,when Cocker had the following stockholders' equity accounts.  To acquire this interest in Cocker,Popper paid a total of $682,000 with any excess cost being allocated to goodwill,which has been measured for impairment annually and has not been determined to be impaired as of January 1,2009.

To acquire this interest in Cocker,Popper paid a total of $682,000 with any excess cost being allocated to goodwill,which has been measured for impairment annually and has not been determined to be impaired as of January 1,2009.

On January 1,2009,Cocker reported a net book value of $1,113,000 before the following transactions were conducted.Popper uses the equity method to account for its investment in Cocker,thereby reflecting the change in book value of Cocker.

-On January 1,2009,Cocker reacquired 8,000 of the outstanding shares of its own common stock for $34 per share.None of these shares belonged to Popper.How would this transaction have affected the additional paid-in capital of the parent company?

Definitions:

Influencing

The capacity or power to affect others’ beliefs, attitudes, or actions by various means, including persuasion, social pressure, or leadership traits.

Traditional Managers

Managers who follow established procedures and practices, often valuing consistency and stability over innovation.

Douglas Conant

An American business executive known for his leadership roles at various companies, including as CEO of Campbell Soup Company.

10-Year Plan

A strategic framework set for a decade, outlining long-term goals, strategies, and milestones for future operations.

Q9: How much foreign exchange gain or loss

Q15: What is the dollar amount of non-controlling

Q30: Compute Simon's share of income from Wilson

Q31: If the combination is accounted for as

Q48: Under the acquisition method of accounting for

Q50: Compute the amount of Hurley's long-term liabilities

Q54: Macroeconomics is the study of<br>A) how wages

Q63: Bauerly Co.owned 70% of the voting common

Q73: Compute income from Stark reported on Parker's

Q90: Wolff Corporation owns 70 percent of the