REFERENCE: Ref.02_03 the Financial Statements for Goodwin,Inc. ,And Corr Company for the for the Year

REFERENCE: Ref.02_03

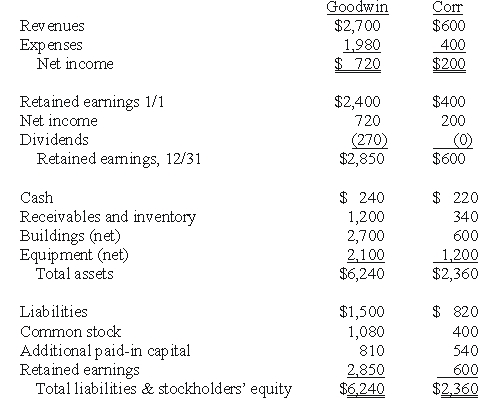

The financial statements for Goodwin,Inc. ,and Corr Company for the year ended December 31,20X1,prior to Goodwin's business combination transaction regarding Corr,follow (in thousands) :  On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

On December 31,20X1,Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to purchase all of the outstanding shares of that company.Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction.Goodwin paid $35 in stock issuance costs.Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-If the combination is accounted for as an acquisition,at what amount is the investment recorded on Goodwin's books?

Definitions:

Consensus Science

Scientific understanding or conclusions that are widely accepted and agreed upon by a significant majority of experts in the field.

Species Loss

The disappearance of species from a habitat or the world, significantly impacting biodiversity and ecosystem functions.

Economically Sustainable

Practices or methods that ensure resources are used in a way that meets current needs without compromising the ability of future generations to meet their needs, ensuring long-term economic stability.

Economic Growth

An increase in the production and consumption of goods and services, indicating the improving economic health of a region or nation over time.

Q1: Parent Corporation recently acquired some of its

Q17: Prepare the journal entry to record payment

Q38: Which one of the following accounts would

Q38: What is the appropriate account to credit

Q49: Develop a predistribution plan for this partnership,assuming

Q74: On January 1,2009,Riley Corp.acquired some of the

Q77: Which of the following is not an

Q80: On January 1,2009,Rand Corp.issued shares of its

Q81: What is Beta's accrual-based income for 2009?<br>A)$200,000.<br>B)$276,800.<br>C)$280,000.<br>D)$296,000.<br>E)$300,000.

Q95: Which of the following statements is false