REFERENCE: Ref.05_02 On January 1,2009,Pride,Inc.bought 80% of the Outstanding Voting Common Stock

REFERENCE: Ref.05_02

On January 1,2009,Pride,Inc.bought 80% of the outstanding voting common stock of Strong Corp.for $364,000.Of this payment,$28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000.Any remaining excess was attributable to goodwill which has not been impaired.

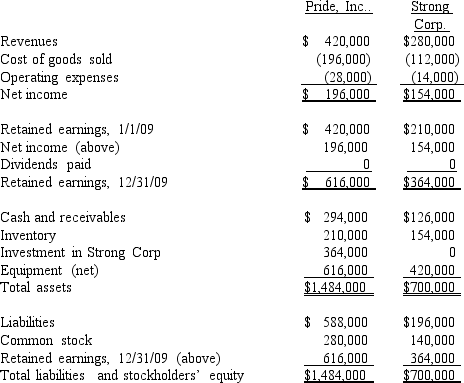

As of December 31,2009,before preparing the consolidated worksheet,the financial statements appeared as follows:

During 2009,Pride bought inventory for $112,000 and sold it to Strong for $140,000.Only half of this purchase had been paid for by Strong by the end of the year.60% of these goods were still in the company's possession on December 31.

During 2009,Pride bought inventory for $112,000 and sold it to Strong for $140,000.Only half of this purchase had been paid for by Strong by the end of the year.60% of these goods were still in the company's possession on December 31.

-What is the total of consolidated operating expenses?

Definitions:

Married Couple

A legal union between two individuals recognized by law, often entailing specific rights, responsibilities, and benefits under the tax code.

Personal Exemption

A deduction that allowed taxpayers to reduce taxable income for themselves and for any dependents claimed, notably reduced to $0 for tax years 2018 through 2025 under the Tax Cuts and Jobs Act.

Qualifying Relative

A designated family member or other individual who meets specific IRS criteria for dependency exemptions.

Blind

A status on tax filings that provides additional deductions or credits for individuals who are legally blind.

Q18: The accrual-based income of Eckston Inc.is calculated

Q22: Scarcity means that society must make<br>A) goods<br>B)

Q23: Wilkins Inc.owned 60% of Motumbo Co.During the

Q56: What is the partial equity method? How

Q58: Which of the following is usually accounted

Q61: The trustor is the<br>A)income beneficiary of the

Q84: For each of the following situations,select the

Q96: What is the consolidated total for inventory

Q99: A company had common stock with a

Q106: Assume that Bellington paid cash of $2.8