REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90% owned subsidiary of Simon Company,bought equipment from Simon for $68,250.On January 1,2009,Simon realized that the useful life of the equipment was longer than originally anticipated,at ten remaining years.The equipment had an original cost to Simon of $80,000 and a book value of $50,000 with a 10-year remaining life as of January 1,2009.

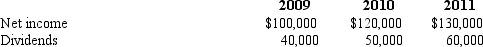

The following data are available pertaining to Wilson's income and dividends:

-Compute the amortization of gain for 2010 for consolidation purposes.

Definitions:

Purpose

The underlying cause or intention behind an action, creation, or entity's existence.

Document

A piece of written, printed, or electronic matter that provides information or serves as an official record.

Templates

Pre-designed documents or files that serve as a starting point for a new project, containing standardized layout and formatting.

Acknowledging

The act of recognizing or admitting the existence, truth, or reality of something.

Q2: The provisions of a will currently undergoing

Q9: The estate of Bobbi Jones has the

Q32: What term is used to refer to

Q41: What is the consolidated total of noncontrolling

Q43: What amount will Coyote Corp.report on its

Q63: Which of the following statements is true

Q83: What was the noncontrolling interest in Boat

Q87: Melvin Company applies the equity method to

Q111: Which of the following is not an

Q161: Which if the following is a normative