REFERENCE: Ref.05_02 On January 1,2009,Pride,Inc.bought 80% of the Outstanding Voting Common Stock

REFERENCE: Ref.05_02

On January 1,2009,Pride,Inc.bought 80% of the outstanding voting common stock of Strong Corp.for $364,000.Of this payment,$28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000.Any remaining excess was attributable to goodwill which has not been impaired.

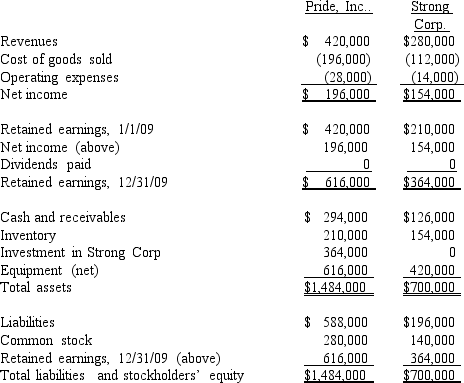

As of December 31,2009,before preparing the consolidated worksheet,the financial statements appeared as follows:

During 2009,Pride bought inventory for $112,000 and sold it to Strong for $140,000.Only half of this purchase had been paid for by Strong by the end of the year.60% of these goods were still in the company's possession on December 31.

During 2009,Pride bought inventory for $112,000 and sold it to Strong for $140,000.Only half of this purchase had been paid for by Strong by the end of the year.60% of these goods were still in the company's possession on December 31.

-What is the consolidated total of noncontrolling interest appearing on the balance sheet?

Definitions:

CPT

Current Procedural Terminology; a set of codes used by healthcare professionals to report and document medical, surgical, and diagnostic services.

ICD

International Classification of Diseases, a system of codes used for classifying diagnoses, symptoms, and procedures.

Upcoding

The fraudulent practice of using billing codes that indicate a more expensive service was performed than was actually provided, to increase reimbursement from Medicare or insurance.

Increased Revenue

An upward trend in the amount of money generated from the sales of goods or services within a company.

Q25: What amount should have been reported for

Q29: Goodwill is often created,or purchased,during a business

Q55: What is the amount of Adjustment to

Q61: On a consolidation worksheet,what adjustment would be

Q73: For the Estate of Kate Tweed,interest of

Q73: Compute the consolidated equipment (net)account at December

Q85: What is the primary accounting difference between

Q88: What is the noncontrolling interest in Gamma's

Q98: A parent acquires 70% of a subsidiary's

Q108: Compute the gain recognized by Smeder Company