REFERENCE: Ref.05_07

On April 1,2009 Wilson Company,a 90% owned subsidiary of Simon Company,bought equipment from Simon for $68,250.On January 1,2009,Simon realized that the useful life of the equipment was longer than originally anticipated,at ten remaining years.The equipment had an original cost to Simon of $80,000 and a book value of $50,000 with a 10-year remaining life as of January 1,2009.

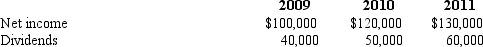

The following data are available pertaining to Wilson's income and dividends:

-Compute the amortization of gain for 2011 for consolidation purposes.

Definitions:

Q12: X-Beams Inc.owned 70% of the voting common

Q28: The following are preliminary financial statements for

Q29: The Home incurred the following liabilities: $110,000

Q31: Which operating segments are separately reportable under

Q36: Which one of the following characteristics of

Q44: Yelton Co.just sold inventory for 80,000 lira,which

Q47: Compute the gain or loss on the

Q58: Consolidated net income using the equity method

Q64: What is the major assumption underlying the

Q69: Strayten Corp.is a wholly owned subsidiary of