REFERENCE: Ref.05_13

Several years ago Polar Inc.purchased an 80% interest in Icecap Co.The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values.Polar paid an amount corresponding to the underlying book value of Icecap so that no allocations or goodwill resulted from the purchase price.

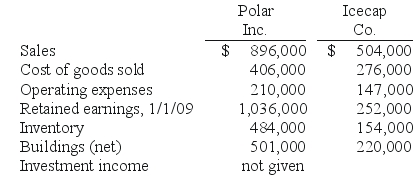

The following selected account balances were from the individual financial records of these two companies as of December 31,2009:

SHAPE \* MERGEFORMAT

-Polar sold a building to Icecap on January 1,2008 for $112,000,although the book value of this asset was only $70,000 on that date.The building had a five-year remaining useful life and was to be depreciated using the straight-line method with no salvage value.

Required:

On the consolidated financial statements for 2009,determine the balances that would appear for the following accounts: (1)Buildings (net), (2)Operating expenses,and (3)Noncontrolling Interest in Subsidiary's Net Income.

Definitions:

Seller

An individual or entity that offers goods or services for sale to consumers or other businesses.

Express Warranty

A seller's explicit promise or guarantee about the condition or quality of a product.

Mechanic

A skilled worker specialized in constructing, repairing, or maintaining machinery, vehicles, or other technical systems.

Brakes

Devices used to slow down or stop a vehicle by applying pressure against a moving part to create friction.

Q1: A not-for-profit organization receives a computer as

Q6: How much goodwill impairment should Pritchett report

Q7: Compute the amount of consolidated inventories at

Q27: What is the minimum amount of revenue

Q51: After acquiring the additional shares,what adjustment is

Q54: What documents or other sources of information

Q74: Compute consolidated expenses at date of acquisition.<br>A)$2,760.<br>B)$3,380.<br>C)$2,770.<br>D)$2,735.<br>E)$2,785.

Q79: Assuming the combination is accounted for as

Q84: How much income tax expense is recognized

Q104: The amount of gross profit for the