Figure:

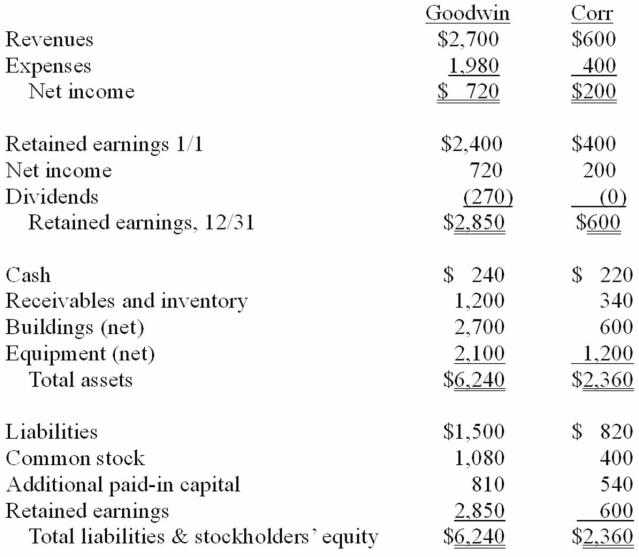

The financial statements for Goodwin, Inc., and Corr Company for the year ended December 31, 20X1, prior to Goodwin's acquisition business combination transaction regarding Corr, follow (in thousands) :  On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

On December 31, 20X1, Goodwin issued $600 in debt and 30 shares of its $10 par value common stock to the owners of Corr to acquire all of the outstanding shares of that company. Goodwin shares had a fair value of $40 per share.

Goodwin paid $25 to a broker for arranging the transaction. Goodwin paid $35 in stock issuance costs. Corr's equipment was actually worth $1,400 but its buildings were only valued at $560.

-Compute the consolidated equipment (net) account at December 31, 20X1.

Definitions:

Eighteenth-Century

A period in history ranging from the year 1701 to 1800, characterized by significant developments in politics, philosophy, science, and arts.

Pin Factory

A classic example used by Adam Smith to describe the benefits of specialization and division of labor.

The Wealth of Nations

A seminal book by Adam Smith that lays the foundations of classical economics and discusses the division of labor, productivity, and free markets.

Adam Smith

An 18th-century Scottish economist and philosopher, often considered the father of modern economics, best known for his work "The Wealth of Nations."

Q1: The Town of Anthrop receives a $10,000

Q16: Kordel Inc.holds 75% of the outstanding common

Q19: What amount of goodwill should be attributed

Q23: Which of the following statements is true

Q25: What is the amount of consolidated net

Q27: Gonda,Herron,and Morse is considering possible liquidation because

Q32: .A local partnership was in the process

Q49: Record the journal entry for the admission

Q73: What is Delta's accrual-based income for 2009?<br>A)$1,091,520.<br>B)$1,115,520.<br>C)$1,168,000.<br>D)$1,168,520.<br>E)$1,200,000.

Q97: Lorne Co.issued its common stock in exchange