REFERENCE: Ref.03_07

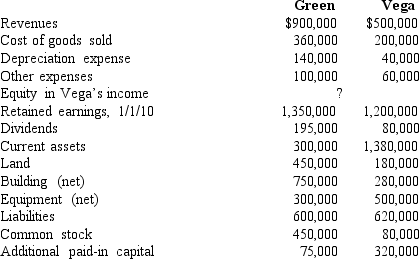

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010,consolidated additional paid-in capital.

Definitions:

Indirect Approach

A communication strategy where the main point or request is not presented immediately but is preceded by context, background, or supportive arguments.

Providing Sample

Offering a portion or example of a product or work to demonstrate quality, style, or function.

Reader's Attention

The focus and engagement of a reader with the content, influenced by factors such as interest, readability, and presentation.

Persuasive Claim

An assertion made in an attempt to convince others of its validity, often used in arguments or advertisements.

Q5: Assume that,at the time of death,the estate

Q10: Where does the noncontrolling interest in Stage's

Q12: What would differ between a statement of

Q25: What amount will be reported for consolidated

Q33: The City of Wetteville has a fiscal

Q42: With regard to the intercompany sale,which of

Q57: On January 1,2009,Cocker issued 10,000 additional shares

Q57: How is contingent consideration accounted for according

Q71: What choices does an administrator of an

Q90: Wolff Corporation owns 70 percent of the