REFERENCE: Ref.03_07

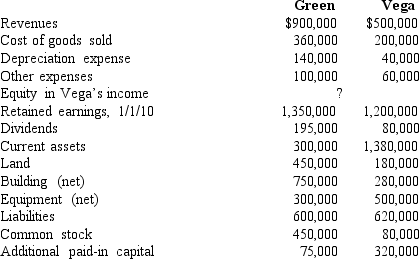

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the equity in Vega's income reported by Green for 2010.

Definitions:

Marginal Cost

The hike in cost resulting from the creation of one more unit of a product or service.

Cartel

An agreement among competing firms to control prices or exclude entry of a new competitor in a market, often leading to higher prices and restricted supply.

Marginal Cost

The hike in overall financial outlay due to producing an extra unit of a product or service.

Total Industry Profit

The cumulative profit earned by all companies operating within a specific industry.

Q15: On June 14,2008,Fred City agreed to transfer

Q15: The employees of the City of Raymond

Q16: Kordel Inc.holds 75% of the outstanding common

Q23: Which of the following statements is true

Q26: Assuming Baker makes the change in the

Q58: The Albert,Boynton,and Creamer partnership was in the

Q67: What adjustment is needed for Webb's investment

Q68: Johnson,Inc.owns control over Kaspar,Inc.Johnson reports sales of

Q77: With regard to the intercompany sale,which of

Q110: On January 1,2009,a subsidiary buys 8 percent