REFERENCE: Ref.03_14

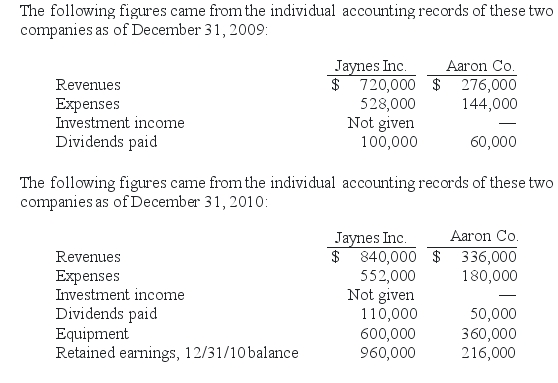

Jaynes Inc.obtained all of Aaron Co.'s common stock on January 1,2009,by issuing 11,000 shares of $1 par value common stock.Jaynes' shares had a $17 per share fair value.On that date,Aaron reported a net book value of $120,000.However,its equipment (with a five-year remaining life)was undervalued by $6,000 in the company's accounting records.Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

SHAPE \* MERGEFORMAT

-If this combination is viewed as an acquisition,what was consolidated net income for the year ended December 31,2010?

Definitions:

Experience

The knowledge or skill that one gains over time through involvement in or exposure to activities.

Application Letter

A formal letter submitted to apply for a particular job or position, outlining the applicant's qualifications and interest in the opportunity.

Professional

Pertaining to or connected with a profession, exhibiting a courteous, conscientious, and generally businesslike manner in the workplace.

Applicants

Individuals who apply for a position, program, or opportunity.

Q5: The employees of the City of Raymond

Q23: On January 1,2009,Payton Co.sold equipment to its

Q24: Give several examples of voluntary health and

Q29: What was the balance in Young's Capital

Q29: The Home incurred the following liabilities: $110,000

Q30: How does a not-for-profit organization record the

Q45: Compute the investment cost at date of

Q58: Which entry would be the correct entry

Q62: When a person dies without leaving a

Q76: When consolidating a subsidiary under the equity