REFERENCE: Ref.02_07

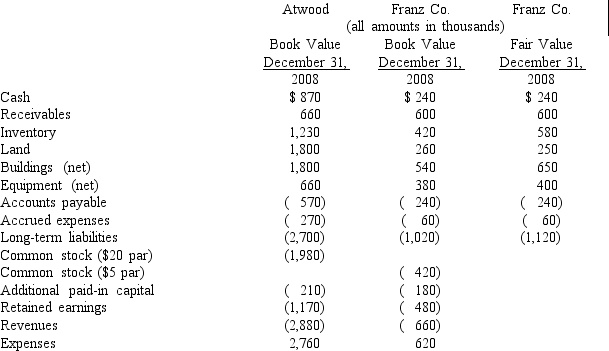

Presented below are the financial balances for the Atwood Company and the Franz Company as of December 31,2009,immediately before Atwood acquired Franz.Also included are the fair values for Franz Company's net assets at that date.

Note: Parenthesis indicate a credit balance

Note: Parenthesis indicate a credit balance

Assume a business combination took place at December 31,2009.Atwood issued 50 shares of its common stock with a fair value of $35 per share for all of the outstanding common shares of Franz.Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.Atwood is applying the acquisition method in accounting for Franz.To settle a difference of opinion regarding Franz's fair value,Atwood promises to pay an additional $5.2 (in thousands) to the former owners if Franz's earnings exceed a certain sum during the next year.Given the probability of the required contingency payment and utilizing a 4% discount rate,the expected present value of the contingency is $5 (in thousands) .

-Compute the investment cost at date of acquisition.

Definitions:

Retarding Spoilage

Methods or techniques used to slow down the deterioration of food or other perishable goods.

Additives

Substances added to something in small quantities to improve or preserve it, commonly used in context with food, fuel, or materials.

Matched Pairs

Matched pairs are a research design in which pairs of subjects are closely matched on key characteristics, with one subject in each pair receiving the treatment and the other serving as a control.

Population Variances

A measure of spread within a distribution or how much the members of the population differ from the population mean.

Q1: For each of the following situations,select the

Q4: Which of the following will not result

Q25: Proprietary funds are<br>A)Funds used to account for

Q29: The Home incurred the following liabilities: $110,000

Q33: What should Dura Foundation report as program

Q42: Where do dividends paid to the noncontrolling

Q48: The life insurance policy was collected.<br>Prepare the

Q62: All of the following are potential losses

Q87: Compute the consolidated common stock account at

Q114: Chain Co.owned all of the voting common