REFERENCE: Ref.03_14

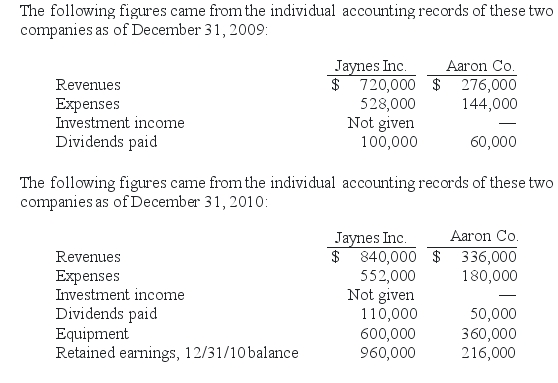

Jaynes Inc.obtained all of Aaron Co.'s common stock on January 1,2009,by issuing 11,000 shares of $1 par value common stock.Jaynes' shares had a $17 per share fair value.On that date,Aaron reported a net book value of $120,000.However,its equipment (with a five-year remaining life)was undervalued by $6,000 in the company's accounting records.Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

SHAPE \* MERGEFORMAT

-If this combination is viewed as an acquisition,what was consolidated patents as of December 31,2010?

Definitions:

Return On Assets

A financial ratio that indicates how profitable a company is relative to its total assets, measuring efficiency in generating profits.

Net Income

The net income of a business following the deduction of all costs, such as operational expenses and taxes, from its overall revenue.

Average Total Assets

An indicator of a company's financial health, calculated by adding the beginning and ending total assets for a period and dividing by two.

Managerial Accounting

The practice of identifying, measuring, analyzing, and interpreting accounting information to help managers make informed business decisions.

Q10: Where does the noncontrolling interest in Stage's

Q19: A gift to a nonprofit school that

Q22: What method is used in consolidation to

Q30: All of the following are examples of

Q40: For a partnership,how should liquidation gains and

Q49: Compute the December 31,2010,consolidated common stock.<br>A)$450,000.<br>B)$530,000.<br>C)$555,000.<br>D)$635,000.<br>E)$525,000.

Q57: If Watkins pays $450,000 in cash for

Q61: On a consolidation worksheet,what adjustment would be

Q72: A special purpose entity can take all

Q111: Which of the following is not an