REFERENCE: Ref.03_07

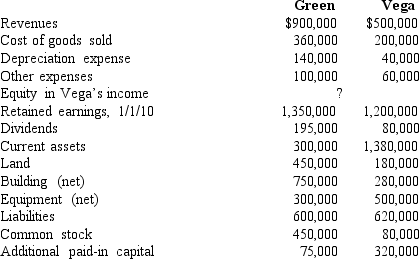

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010,consolidated equipment.

Definitions:

Institutional Racism

A system of policies and practices entrenched in established institutions, which result in the unfair disadvantage to individuals or groups based on race.

Cultural Competency

The ability to understand, appreciate, and interact effectively with people from different cultures.

Microaggressions

The everyday, subtle, intentional — and oftentimes unintentional — interactions or behaviors that communicate some sort of bias against historically marginalized groups.

Implicit Biases

Unconscious attitudes or stereotypes that influence an individual’s understanding, actions, and decisions in an unconscious manner.

Q1: What financial schedule would be prepared for

Q6: The provisions of a will currently undergoing

Q29: What was the amount of income tax

Q34: The Keaton,Lewis,and Meador partnership had the following

Q40: Under SFAS 141(R),what will Harrison record as

Q40: What is Ryan's percent ownership in Chase

Q45: Under modified accrual accounting,when are expenditures recorded?

Q45: A five-year lease is signed by the

Q45: A parent company owns a 70 percent

Q46: Which statement is false regarding the government-wide